January 05, 2011 VOLUME: 2 ISSUE: 1

Troubleshooting FCC Catalyst Losses

Catalyst Loss Investigation Techniques and Practical Strategies

The correct approach to reducing FCC unit catalyst losses depends on the investigating technique, as there are various “types” of catalyst losses that can occur while the unit is in operation.

Catalyst losses were reported as an “issue” at 15% of the FCCUs recently surveyed. Many units will experience some form of catalyst containment-related situation during the course of a four-to-five year run between turnarounds. In anticipation of these concerns, the troubleshooting process should begin when the unit is operating normally (i.e., when the unit is not in trouble). This is the crucial time to collect good baseline data for future troubleshooting efforts, and should include:

- Heat and mass balance with coke calculation

- Regular e-cat and fines sample results

- Regenerator catalyst loss sample (ESP, scrubber water, TSS) with particle size distribution (PSD) and chemical analysis

- Slurry ash content with PSD and chemical analysis

- Pressure surveys

- Catalyst balances

- Accurate drawings of reactor/ regenerator equipment

- Radiotracer or gamma scans.

Catalyst Loss Estimation

Calculation of catalyst losses during normal operation should be conducted over several weeks or even months due to the “uncertainty” in this calculation. The data for these calculations are often cumbersome to obtain. The idea is not to target precise closure in this balance. Rather, look for an approximation of the steady state catalyst losses. If one part of the equation is difficult to obtain with reasonable accuracy, assume 100% closure and calculate this portion by difference.

An accurate catalyst loader with recorded data is preferable for performing a catalyst balance in addition to information on catalyst deliveries (on a dry basis). Changes in fresh catalyst hop per and regenerator catalyst levels (i.e., physical level change and bed density) should also be recorded.

Catalyst losses on the reactor side should include calculation of wt% ash (not vol% BS&W) and as-produced slurry product mass flow. Catalyst losses on the regenerator side should include the scrubber’s purge water wt% solids and rate and the ESP (or other dry recovery) in terms of total tons collected for disposal and opacity.

Serious Catalyst Losses

A unit shutdown is required if serious catalyst losses cannot be stopped quickly. Possible causes for these unsustainable losses include changes in catalyst bed level (Figure 1), severe cyclone failure and operational upsets.

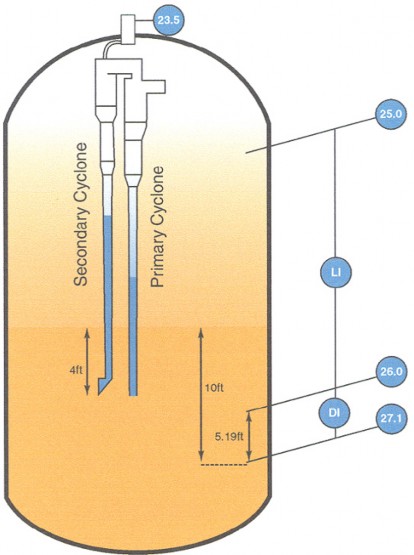

The bed level should be estimated in absolute terms (i.e., height above reference point) using pressure survey data and/or level instrument reading.

Fluidized FCC catalyst behaves like any other fluid and generates a static pressure head. However, FCC catalyst does not have a “typical” fluidized density. The density (ρ) depends on the fluidization conditions, so the density needs to be measured inside the bed to calculate bed level:

ρbd = ΔPdt/hdt

Where ρbd is the regenerator bed density, ΔPdt is the pressure differential inside the bed over a known vertical distance hdt as illustrated in Figure 2. From the pressure recordings and levels shown in Figure 2, the bed density can then be calculated as:

ρbd = ((27.1 – 26.0)lb/in2 x 144)/5.19 ft = 30.5 lb/ft3.

The bed level is calculated with the following equation:

hbd = ΔPbd/ρbd

Where ΔPbd is the pressure differential across the bed , ρbd is the previously calculated regenerator bed density and

hbd is the catalyst height:

hbd = (27.1 – 25.0)lb/in2/(30.5 lb/ft3) = 10 ft.

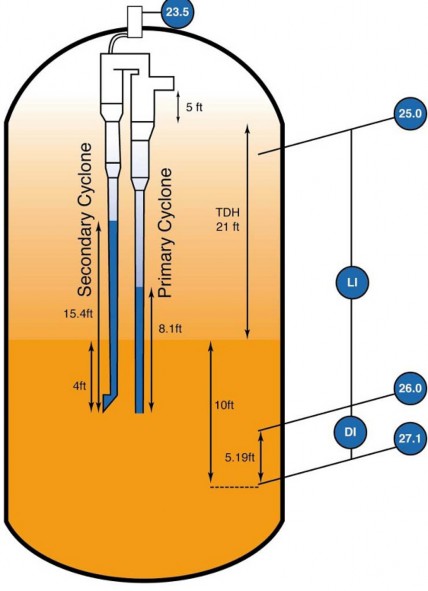

The transport disengaging height (TDH) is the height above the regenerator bed where the catalyst density (entrainment) is constant. Catalyst entrainment is much higher below TDH as illustrated in Figure 3 (see page 3). TDH should terminate below the primary cyclone inlet in order to minimize catalyst entrainment and losses. TDH is calculated with the following equation:1

Log10TDH20 = Log1020.5 + 0.07(V – 3) TDH = TDH20 + 0.1(D – 20)

D = 32 ft, V = 2.8 ft/s. TDH = 21 ft.

Where D is regenerator diameter (ft.)

and V is superficial velocity (ft/s).

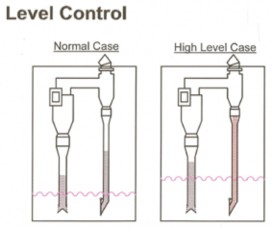

Catalyst levels inside the cyclone diplegs can be estimated from pressure survey data. Dipleg levels should terminate below the cyclone body. Action to take if cyclone dipleg levels are high include:

- Reduce air rate

- Increase pressure

- Lower bed level.

The level in the secondary dipleg can be estimated by the following equation:

L2 = (ΔPcyclones)/ρd2 + Ldiplegsubmerge2(ρbd/ρd2) ρd2 = 20 to 25 lb/ft3

ρbd = bed density.

The level in the primary dipleg can be calculated by a similar equation but typically the primary dipleg is not limiting.

In terms of bed level relative to the diplegs, certain criteria need to be con- sidered depending whether or not the diplegs are intended to be submerged:

- The diplegs should not be submerged if this was not intended in the design

- The diplegs should be properly submerged if they were intended to be submerged (i.e., too high submergence leads to high levels in cyclone dipleg and not submerged enough leads to gas flow up dipleg).

Cyclone failures or obstructions can occur due to poor fluidization around dipleg discharge; coke or refractory lodged in the top of the dipleg; contaminant deposits in the dipleg and mechanical failure during a thermal cycle. Contaminant deposits forming in the diplegs can completely block the dipleg until no catalyst can flow through the dipleg. Sources of contaminants include feed metals, purge water or contaminated fresh catalyst.

Manageable Catalyst Losses

Most FCCUs will have equal catalyst losses from the reactor and regenerator. Part of estimating the size of the problem is to ascertain if catalyst loss rate increased suddenly or if it has gradually drifted higher with time. Sudden increases can be due to operational changes or from recent equipment damage. Gradually increasing losses may be due to changes in catalyst physical properties or from a cyclone hole increasing in size over time. In the refining industry, acceptable FCC catalyst losses are less than 0.10 lb/bbl while elevated catalysts losses are higher than 0.15 lb/bbl. Higher catalyst usage can lead to higher catalyst losses. For example, catalyst usage at one refinery increased from about 0.40 lb/bbl (initially) to about 0.95 lb/bbl over 18 months of operation, leading to a corresponding increase in catalyst loss at about 0.05 lb/bbl (initially) to about 0.15 lb/bbl (after 18 months). The following is a “data checklist” for troubleshooting catalyst losses:

- E-cat data should include historical and current chemical and particle size analysis results

- ESP, scrubber purge water or third stage separator fines analysis should include historical and current chemical andPSD analysis

- Slurry analysis should include historical and current ash content and PSD with chemical analysis (if available),

- Past and present reactor/regenerator pressure surveys

- Catalyst balances performed over several weeks

- Radiotracer or gamma scans.

Fines Generation

Flow meters on all distributors should be checked when investigating fines generation. A pressure survey of all dis- tributor inlets should also be performed along with calculation of distributor exit velocities. It should be noted that jet velocities greater than 300 ft/s can cause attrition. Fluidization taps should be checked for normal flow along with torch oil steam flow valves should be checked for leaks.

The fresh catalyst PSD should be checked so that less than 5% is in the 0 to 20 micron range and less than 20% is in the 0 to 40 micron range. PSD should be verified if PECAT is used. A sample should be sent to the refinery’s catalyst vendor. Manufacturing changes or catalyst reformulations should also be taken into consideration.

E-cat data combined with other observed changes, such as mechanical problems with cyclones (e.g., holes resulting from abrasion), can also provide clues to high catalyst/fines losses. A sharp along with slurry product flow rates confirmation of dry steam. In addition, increase in PSD over time (e.g., 162 operating days). Observation of coarser PSD (e.g., 90 μm at shut- down vs 75 μm at SOR) indicates loss of fines. Losses could also steadily increase if there is a hole in a cyclone or plenum that gets larger over time. If cyclone ΔP instrumentation is in operation, a downward ΔP trend indicates there is a cyclone problem resulting in loss of fines.

Fluidization Issues

Erratic circulation is only one fluidization issue. Submerged diplegs are effectively blocked if the bed around them isn’t well fluidized. E-cat Umb/Umf should be monitored. APS and ABD affect Umb/Umf. Watch for signs of air maldistribution, including:

- Unusual temperature profile in the regenerator

- Afterburn

- CO issues.Other potential issues include operating cyclones in the “danger zone” (i.e., 15-35 ft/s). This is often an issue during startup. High entrainment resonating from either abnormal superficial velocity or a damaged air distributor can choke a cyclone.

Flapper Valve

A thorough inspection at each turnaround is necessary to ensure proper flapper valve operation. The inspection should

include the following check list:

- Check the seating surface for proper seating and minimize gaps

- Check the counterweight and adjust

- Check the bushings and ensure clearances are within tolerances

- Check the pin for straightness and grooving and lap the pin as necessary

- All clearances and tolerances should be in accordance with the original manufacturing drawing.

Horizontal counterweight (CWT) valves do not allow catalyst and spalled refractory to slide off. Valves are not wide open during operation so a build-up of rubble can block the flow or cause the valve to stick open.In addition, erosion at the bottom of the dust hopper and top of the dipleg is frequently a problem. Additional refractory protection on outside of cyclones can prolong equipment life. Moreover, precise design and implementation of a refractory protection strategy is critical.

Conclusion

In view of all the previously discussed precursors leading to excessive catalyst losses through the FCC reactor and regenerator, an effective strategy depends on the specific source of the

trouble. In summary, gathering baseline data is critical when troubleshooting catalyst losses. Extreme losses are often the result of improper catalyst level control. E-cat data and SEM photos can provide clues to the problem’s origins. Fortunately, low cost options are available, such as when responding to recurring cyclone problem areas. n

Literature Cited

Wilson, J., “Fluid Catalytic Cracking Technology and Operation,” Tulsa, OK: Penwell, 1997, pp. 188-189.

Editor’s note: This article is based on a presentation by Jeff Koebel at the 2010 NPRA Cat Cracking Conference: “Troubleshooting FCC Catalyst Losses” (CAT-10-105). Koebel is Sr. Technical Sales Manager at Grace Davison, Co- lumbia, Maryland, USA (jeff.koebel@ grace.com).

PROCESS OPERATIONS

Economics of H2 Recovery from Off Gas

Hydrogen recovery from refinery off gas can be economically competitive depending on site-specific conditions and market factors.

Market factors can include the price of natural gas affecting the relative competitiveness of hydrogen production from steam methane reformers (SMR). Most refiners with ramped up hydrotreating and hydrocracking capacity rely on SMR hydrogen production for most of their increased hydrogen requirements. However, H2 recovery from off gas is becoming more compelling as many SMRs are already at maximum capacity.

Based on published papers available from technology licensors, technical considerations include H2 concentration in the off gas (e.g., richer H2 content streams require less compression), separation technology (e.g., membrane separation and pressure swing adsorption [PSA]) and gas stream pressure. High pressure gas streams with relatively high H2 content, such as purge gas from high pressure hydrotreaters, are generally good candidates for H2 recovery as they require less compression and are richer in H2. For better economics, such high H2 content streams should not be commingled with lower quality off gas prior to recovery.

In some cases, instead of off gas recovery system investments, the refinery off gas is fed to the SMR plant for steam reforming to H2. In addition, new high-activity reforming catalysts can increase hydrogen SMR production by as much as 15%. The increasing interest in substituting off gases for natural gas are to increase overall H2 availability. In addition, the heavier hydrocarbons in off gases will provide more moles of hydrogen product than natural gas.

For refinery off gases which have more than 35 to 45% hydrogen, the economics for recovering that hydrogen with a membrane or PSA become much more favorable.

Process Heater Efficiency Update

In basic terms fired process heaters, of which there are thousands in the refining industry, are used to effect a chemical reaction in the hydrocarbon feedstock through the application of heat. The majority of these units are fired with a gaseous fuel (e.g., natural gas and plant process gas). The units may range widely in size but all units are known to be controlled to various extents for emissions of hazardous air pollutants (HAPs), mainly NOx. The level of NOx emissions limits varies among refining regions, but the general trend is towards achieving less than 10 ppm NOx emis sions (< 10 ppm NOx). These NOx emissions reduction efforts coincide with improving combustion efficiency.

Many installed heaters are not equipped with combustion air preheaters for energy recovery from stack gases, resulting in a 7 to 10% energy consumption loss. This is primarily because the energy recovery technology was not judged cost effective at the time of construction for small and moderate duty process heaters. In the ensuing issues of Refinery Operations, discussions will be included on development of designs and components for an integrated process heater technology that may be applicable to retrofit of existing equipment, including low NOx burner development, computational fluid dynamics (CFD) design support, monitoring and measurement systems, and efficiency improvement strategies (e.g., oxygen enrichment).

Process heaters, furnaces and other fired heater applications account for most of the energy costs associated with running hydrocarbon processing plants, which is where most of the energy savings strategies are targeted. For example, continuous measurement of oxygen (O) and combustibles in the heater’s radiant section provides data for effective heater operation with significant benefits in energy savings, NOx reduction, product quality and throughput, tube life and safe heater operation. Variations in fuel values, higher operating temperatures and multiple burners complicate fired heater combustion optimization.

In an effort to monitor the cost savings realized by process heater efficiency improvement programs, combustibles and oxygen should be monitored. In addition, air-to-fuel ratio step testing, such as on crude heaters, vacuum heaters, and process heaters in general, can be part of the monitoring program.

Test devices used can include analyzers such as the AMETEK P-300 por table flue gas analyzer and a facility’s Honeywell TDC 3000 DCS to obtain required data. Parameters that could be monitored during heater air-to-fuel ratio step testing exercises include excess O2, CO, NO, excess air, process heater duty (firing rate) and stack temperature.

These step testing exercises usually involve a collaborative effort from various levels of refinery staff, along with the supplier of specialized instrumentation and associated services. For example, at one facility, personnel typically involved include an instrumentation technician, unit operator and control room operator.

Avoiding Over Conversion in Unit Operations

Maximizing cycles of conversion units such as hydrotreaters and hydrocrackers are being achieved by control of critical operating parameters. Plant optimization systems and DCS technology are prominently leveraged in newer facilities to facilitate control of critical parameters. Older facilities are also incorporating various layers of optimization systems for critical parameter. For example, at the NPRA Q&A, David Krenzke with Advanced Refining Technologies (ART), pointed out that refiners are maximizing ULSD unit cycle length by controlling the following operating parameters:1

- Hydrogen purity: For ULSD operations, ratios of hydrogen consumption to hydrogen-to-oil in excess of 5 to 6 provide greater stability and optimum catalyst performance

- Feed distillation: The feed end point has a significant impact on the required temperature to meet a product sulfur target. Increases in feed boiling point quickly in- crease the concentration of hard sulfur as well as increasing nitrogen and PNA levels. A high end point tail on the feed distillation will reduce the temperature span between SOR and EOR by requiring a higher WABT to produce the same product specifications, which in turn increases the deactivation rate as well as increasing hydrogen consumption

- Sulfur conversion: Over-conversion even by 1 or 2 ppm can significantly increase the catalyst deactivation rate. Higher temperatures to produce a lower product sulfur than needed increase coke deposition causing a higher rate of deactivation. Some refiners are using closed loop control with an on-line product sulfur analyzer to maintain on-spec product to prevent over-conversion

- Feed composition: Higher concentrations of cracked stocks (coker & LCO) increase the concentration of hard sulfur which requires higher temperatures to remove. Cracked stocks also increase the olefin and PNA concentrations in the feed resulting in an increase in hydrogen consumption, higher exotherms and lower outlet hydrogen partial pressure. The net effect is a shorter cycle length due to higher operating temperatures and an increase in deactivation rate.

1. Response by David Krenzke at the 2010 NPRA Q&A and Technology Forum, see conference Answer Book, Question #22, p. 74, “Maximization of ULSD unit catalyst life/ cycle length.” n

FCC Catalyst Multi-Loader Systems

As refiners add different types of additives to FCC operations, multi-loader systems are growing in importance. Different variations of multi-loader systems are available from catalyst suppliers. These multi-loaders are typically designed so that they are easy to move, such as Intercat’s Additive Inventory Management System (AIM System). This particular system can accommodate five different additives, including fresh catalyst, E-cat as well as other competitor’s catalyst formulations.

Multi-loaders are typically retrofitted to each particular FCC unit. However, obtaining permits for installation of these additive multi-loaders is an issue for some refiners, as the FCC unit is the focus of many of the environmental issues overwhelming refiners.

INDUSTRY NEWS

Valero Revamps and Startups

Valero Benicia refinery temporarily suspended normal operations in late December to conduct planned, preven- tative maintenance work that could not otherwise be done when the refinery is fully operational. According to informa- tion from Valero, the turnaround is ex- pected to last about 36 days, beginning in January and ending in February.

During the turnaround, the flue gas scrubber (FGS) unit, designed, reviewed and permitted as part of the larger project known as the Valero Improvement Project (VIP), will be “tied-in” to the processing units. This new unit will reduce emissions of nitrogen oxide (NOx), sulfur dioxide (SOx), and particulate matter (PM). The FGS project also includes equipment to heat crude oil more efficiently and produce steam without consuming additional fuel. In addition, obsolete equipment will be removed from service.

Maintenance work will be conducted around-the-clock. At peak times, approximately 3,000 skilled workers will be assigned to the turnaround, with up to 1,300 working during peak shifts.

The Valero Energy Aruba refinery will reach planned rates by the end of the month following the restart of pro- cess units on Jan. 2. The refinery recently completed months of extensive turnaround maintenance to facilitate its return to service; the plant was shuttered in July, 2009 owning to poor refining economics.

Also, the FCCU at Valero’s Ardmore, Oklahoma, refinery is at planned rates, the company said on January 3 following

the unplanned shutdown on December 28 to repair a leaky pipe.

JX Nippon Oil & Energy Corp. “Steadys”2011 Refining Capacity

Japan’s JX Nippon Oil & Energy Corp, a unit of JX Holdings Inc said in late December that it restarted its 30,000 barrel per day (bpd) hydrocracking unit and a 16,000 bpd residue hydrodesul furization unit at its Muroran refinery in northern Japan at the end of December. The units had been shut since Dec. 20 due to a problem. According to a Dec. 27 report from Reuters, JX Nippon Oil & Energy Corp plans to refine 6.63 million kilolitres (1.35 million bpd) of crude oil in January for domestic con sumption, steady from a year earlier, a company executive said after the New Year weekend. That compared with 6.65 million kl refined in January 2010.

The January plan includes some refining to make up for a shortfall in December after unplanned shutdowns at some refineries, Tsutomu Sugimori, senior vice president in charge of retail fuel sales, told reporters.

The company estimated its December crude refining for the domestic market at 6.30 million kl, down 3% from a year earlier, below its target of 6.58 million kl after unplanned shutdowns of some refining units at plants in Muroran, Negishi and Kashima. “This year, oil refiners have curbed refining effectively to meet demand, which led to improved margins,” Sugimori said. “But we don’t know whether the domestic and export markets will be as good next year as this year.”

The company exported 490,000 kl of middle distillate and fuel oil in December, up 130,000 kl from a year ago, Sugimori said. The refining vol- umes do not include condensate but include crude processed at its 51% owned venture with Petrochina, Osaka International Refining Co, an export- oriented 115,000 bpd refinery. It plans no refinery maintenance in January. The company, a wholly owned down- stream oil subsidiary of JX Holdings Inc. has group crude refining capacity of 1,507,200 bpd.

Algiers Refinery Revamp Contract

Technip has been awarded a refinery refurbishment and revamping contract by Sonatrach for the Algerian company’s Algiers refinery. This lump sum turnkey contract, worth approximately US$908 million, will last 38 months and cover the execution of the complete scope of works, including the design, supply of equipment and bulk material, construction and start-up.

The revamp of the existing installation will enable refining capacity to be increased from 2.7 to 3.6 mil- lion tons per year, Technip said in a statement. The new units will allow the refinery to produce gasoline at specifications similar to those in force in Europe. The project will be carried out by Techip’s operating center in Paris. The project is part of Sonatrach’s vast program to renovate and refurbish the country’s oil refining installations.

Global Coking Capacity Increasing to 373 MMTPA by 2015

A report from Research and Markets (www.researchandmarkets.com), “Global Refinery Coking Units: Market Analysis, Capacity Forecasts and Competitive Landscape to 2015,” indicates that global coking capacity is expected to increase from 291.1 MMTPA in 2009 to 373.2 MMTPA in 2015 at an average annual growth rate (AAGR) of 4.1%. Of the 82.1 MMTPA capacity increase, 66% will be from the world’s largest coking markets – the US, China and India. Together, these three markets will witness an increase of 53.8 MMTPA

in this period. Increasing domestic demand is the major driver for the capacity growth in these markets. In addition, India and China also plan to emerge as leading petroleum product exporters, which is also encouraging their investments in the coking industry.

The new report also notes that despite possessing the largest crude oil reserves, Middle East and Africa has limited presence in the global coking industry. Around half of the world’s oil reserves are located in this region. As of 2009, the region had a coking capacity of 7.1 MMTPA, accounting for less than 3% of global capacity. This is largely due to relatively low demand for cleaner products in the region. As the regional and national emission rules in this region are not stringent, low-quality petroleum products are consumed in the region. However, with most oil-producing countries planning to emerge as leading petroleum product exporters, the number of complex refineries in the region is increasing. By 2015, the Middle East and Africa coking capacity will more than double to 15.1 MMTPA.

HMEL Guru Gobind Singh Refinery Project

The HPCL-Mittal Energy Limited (HMEL) 9.0 MMTPA Guru Gobind Singh refinery project in Bathinda, Punjab will be a zero bottoms, energy efficient, environmentally friendly, high distillate yielding complex refinery that will be producing clean fuels and polypropylene by processing heavy, sour

and acidic crudes. The facility will include a captive power plant of 165 MW for refinery power and steam requirements. The refinery configuration has been developed after extensive linear programming, keeping the domestic and regional requirements in mind, the latest cost effective technologies available for generating required fuel specifications, and future changes. The configuration translates into one of the highest Nelson Indexes for the refinery amongst all the refineries in India. HMEL is a joint venture between Hindustan Petroleum Corporation Limited and Mittal Energy Investment Pte Ltd, Singapore. n

EDITORIALLY SPEAKING

Refinery Profitability: A Study in Contrast

Right before the Christmas break, I had lunch with some representatives of a major technology licensor that is significantly increasing its engineering staff and moving in to an ultra- modern campus in the Houston area to accommodate this influx of technical experts. Increases in staffing levels at their Asian offices are also in progress. With refined product demand in most parts of the world expected to remain at levels slightly above 2010 consumption, many technology suppliers are currently engaged in working with refiners on projects driven by shifting product requirements, efficiency improvements and environmental legislation. This bodes well for many of the major technology suppliers.

However, not all projects are the exclusive domain of the big engineering and technology suppliers. For example, the representative of a company specializing in cleaning process units prior to, or during a turnaround, has recently opened a new office in California to provide better service for the six refineries operating in the Los Angeles area. Another small but specialized engineer- ing firm that I met with in late December has been so busy with new work targeting crude unit revamps scheduled in 2011, that their staff only took a brief vacation during the Christmas holidays.

Nonetheless, while there are expected improvements in processing profits in 2011, the expected rebound

example, according to a report at the end of November from Bloomberg’s Singapore office, “the growth of refined product demand in China, the world’s biggest energy consumer, will slow to ‘half or less’ of the country’s gross domestic product rate [in 2011] as in- flation accelerates and the government discourages car usage.”

Other major concerns include statements from the U.S. Environmental Protection Agency (EPA) that it will take action to roll out its own new regulations on greenhouse gases. A senior administration official recently told the Reuters news agency: The agency “has a huge role to play in continuing the work to move from where we are now to lower carbon emissions,” said the official, who did not want to be identified as the EPA policies are still being formed.

President Barack Obama, looking to take the lead in global talks on green- house gas emissions, has long warned that the EPA would take steps to reg- ulate emissions if Congress failed to pass a climate bill. The senior official stopped short of saying the EPA alone would achieve Obama’s goal of about 17% percent reductions in greenhouse gases by 2020 from 2005 levels.

The EPA is working to regulate greenhouse gases from “stationary sources” at refineries and other manufacturing facilities. In 2011, the EPA will require large power plants, manufacturers and oil refiners to get permits though details are unclear. The EPA will also require industrial sources to submit analyses on the so-called “best available technology” they could add to their plants to cut emissions under the existing Clean Air Act.

In today’s fragile economy, the Obama administration doesn’t seem to take into consideration that regulations from its bureaucrats will harm an industry trying to emerge from the worst recession since the Great Depression of the 1930s, while the governments of other countries make efforts to help their sustain their manufacturing industry. For example, Japan has postponed its plans to introduce an emissions trading scheme (ETS) that would have gone into effect in 2013. This would have put Japanese refiners at a competitive in consumption of refined products will remain “fragile” in certain markets. For for releasing greenhouse gas emissions, disadvantage relative to other Asian refiners.

Regardless of these concerns and recent environmental disasters, such as the Gulf of Mexico oil spill, a recent Wall Street Journal report puts global upstream investment in drilling and exploration at over half a trillion dollars in 2011 as some analysts expect oil prices to reach $100 per barrel in mid-2011. Surprisingly, much of this investment is coming from major oil companies rather than state-run monopolies, as was the trend over the past 10 years. Most of this investment is to replace dwindling reserves rather than meet increased demand. It therefore stands to reason that downstream investments will soon follow to accommodate increased processing complexity needed to upgrade these crudes with more complex “chemistry.” Rene Gonzalez, Editor

Regardless of these concerns and recent environmental disasters, such as the Gulf of Mexico oil spill, a recent Wall Street Journal report puts global upstream investment in drilling and exploration at over half a trillion dollars in 2011 as some analysts expect oil prices to reach $100 per barrel in mid-2011. Surprisingly, much of this investment is coming from major oil companies rather than state-run monopolies, as was the trend over the past 10 years. Most of this investment is to replace dwindling reserves rather than meet increased demand. It therefore stands to reason that downstream investments will soon follow to accommodate increased processing complexity needed to upgrade these crudes with more complex “chemistry.” Rene Gonzalez, Editor

Copyright 2010 by Refinery Operations. Reproduction prohibited except for further use by the purchaser and expressly prohibited for resale. This information is obtained from the public domain and the intelligence of the staff of Refinery Operations. While every effort is taken to ensure accuracy, it cannot be guaranteed that this information has not been superseded. Refinery Operations cannot be held liable for the results of actions taken based upon this information.